Unlocking Value Through Strategic Investments

We are a private investment firm / family office focused on identifying and unlocking value across high-growth real estate markets, specialty finance, distressed assets, and emerging small-to-mid-sized businesses. With a long-term, opportunistic approach, we deploy patient capital across a diversified portfolio, leveraging deep market insight and operational expertise to generate attractive, risk-adjusted returns.

Our investment strategy emphasizes flexibility, allowing us to participate across the capital stack—ranging from direct equity investments and structured debt to opportunistic acquisitions of underperforming or distressed assets. We seek out overlooked opportunities with strong fundamentals, scalable business models, or repositioning potential, where our strategic involvement can drive growth and long-term value.

Pan-Asia Business Consulting | Help foreign countries navigate in US.

Cross-boarder Business Consulting

80+industry experience across multiple sectors

Our experience professionals are from the top investment firms and investment banks mostly.

Years of Combined Experience

Active in private investment in small to mid-size companies, management consulting, distressed assets, and loan for companies with immediate cashflow needs.

Active Markets

Our Investment Focus

Discover our diverse investment strategy and portfolio highlights, which showcase our commitment to value creation in various sectors.

Our flexible approach allows us to adapt and seize opportunities across the capital stack.

Diversified Portfolio

We invest in a range of sectors including real estate, finance, and distressed assets.

Operational Expertise

Our team leverages extensive market knowledge to drive value and returns.

Flexible Investment Strategy

We adapt to market conditions, participating across the capital stack.

Management Consulting

We support businesses with turnaround strategies and growth initiatives.

"Data-backed investments with a strong track record of success"

We believe that a high-conviction investments founded on rigorous research and reliable outcomes. In addition, we also believe that an investment qualitative assessment is also key when we deal with investments/consulting.

Your Partner in Private Equity Solutions

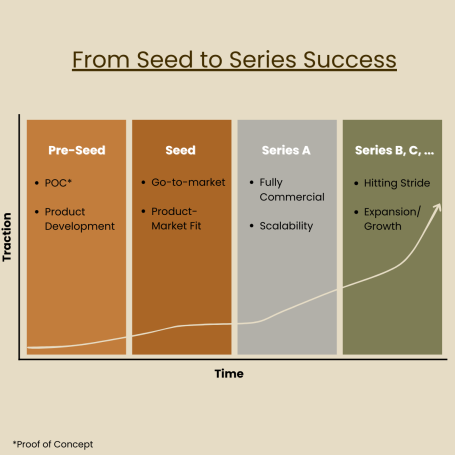

We invest directly in small to mid-sized companies with strong growth potential, offering support through equity or debt restructuring, mezzanine financing, management consulting, and flexible structured loans. Additionally, we assist both domestic and international start-ups entering the U.S. market. Whether it's real estate investments or manufacturing ventures, managing operations across multiple states and countries can be complex. Our team brings deep expertise in both scaling businesses and executing successful turnarounds. We do not invest in public stocks or bonds. Instead, we like to think we invest in the people that run the businesses.

Consider us your partner in driving your business toward its goals. Think of us as an extension of your team, dedicated to helping you achieve your business goals.

Our Team Experiences:

Synergy Vista Capital Management Team

John Lee, CEO (Co-founder)

John started out his career as in investment consulting advising pension, corporate, endowment and foundations on asset allocation, manager selection among other duties. He later decided to work in Asia before Global Financial Crisis at an investment bank later becoming Head of Equity Sales where he won many accolades for his achievements. John holds an economic degree in Economics from UCLA.

Edward Han, Global Head of Operation (Co-founder)

Edward started out his career as in the hospitality business where he later as an executive led global strategies from hotel development to management for few of the largest hotels and casinos in the world. He also managed a family office

investing in small to mid-size enterprises as an investor helping companies grow and achieve their goals.

Alex Lashkari, Board of Director

Alex serves as management at Goldbook, where he supports advisors and leads recruiting, training, and coaching for new financial professionals. He began his financial services career with State Farm, setting agency records for monthly premiums in October 2021 and March 2022, and later worked with MassMutual Pacific Coast. Alex holds a degree in Economics with a minor in International Relations from the University of California, Riverside.

Jeffrey Chan, Board of Directors, (CTO)

Jeff is the CEO and Founder of CarScout.ai, an AI-powered platform that helps used car buyers find, compare, and negotiate smarter. He began his career in digital marketing across automotive, e-commerce, fashion, and media before co-founding Fox Dealer, which he scaled for eight years and successfully sold after it became the #1 fastest-growing automotive company in the U.S. Jeff holds a degree in Computer Science from the University of Michigan.

On-going projects:

Given our diverse experiences, we are able to combine our network and knowledge to create a strategic plan for our clients.

Finacial Advisory -Asset Allocation | Building Development, land permit and oversight of construction | Investing in chain of coffee/bakery | Consulting in K-Beauty Co | Fundraising for Hotel in the US that affiliated with some of the biggest players | Real Estate as an investment (retirement, correlation benefits, and capital appreciation | Investment in a start-up beverage company | Network Solution with Industry Experts

Contact us:

Info@synergyvistacapital.com

Main: 675 S Green Valley Parkway #1334, Henderson, NV 89052 United States| Remote offices: Costa Mesa | La Jolla

Phone: 702-764-1102